With the August 2022 passage of the Inflation Reduction Act (H.R. 5376), energy efficiency, building electrification and home decarbonization projects received a major boost. Increased federal tax credits, point of sale rebates, and income qualified energy efficiency programs are developing.

Here’s what we know about the Inflation Reduction Act (IRA) and the tax credits and rebates that will be coming available for homeowners to make clean energy improvements to their homes.

Federal Tax Credits: Energy Efficient Home Improvements

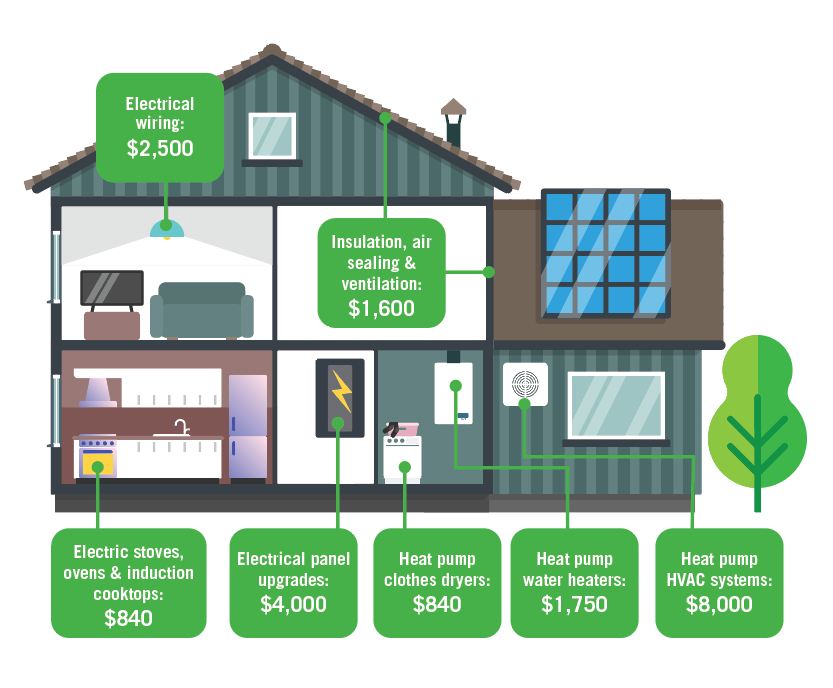

The 25C Tax Credit (previously named “Nonbusiness Energy Property” credit) has been renamed the “Energy Efficient Home Improvement Credit.” For improvements made after January 1, 2023, households may qualify for a $1,200 annual tax credit (replacing the previous $500 lifetime limit), up to a cap of $600 per measure (with exceptions noted below.) The tax credit may be equal to 30% of the costs for all eligible home improvements made each year. So, you can spread out your home improvement projects over multiple years and apply up to $1,200 in annual tax credits. Claimed on an individual’s tax return when filing the year after improvements are made, eligible measures include:

- energy audits (up to $150 credit)

- air sealing and insulation

- heat pumps (up to $2,000 credit)

- heat pump water heaters (up to $2,000 credit)

- electric panel upgrades

- energy-efficient HVAC systems

- energy-efficient windows and doors ($500 total for all exterior doors)

Some installations must meet certain efficiency criteria, like an Energy Star ratings, which varies by item.

This guide from The New York Times provides a good overview of the tax credits available as of February 2024.

This article from BPA provides additional guidance on the federal tax credit requirements.

Colorado Tax Credits and Rebates: Heat Pump Incentives

A new Colorado State tax credit for heat pumps and heat pump water heaters went into effect on January 1, 2024. The heat pump tax credit is now available to install the following types of Energy Star certified heat pumps or other technology:

- air-source heat pump

- ground-source heat pump

- water-source heat pump

- combined-source heat pump

- heat pump hot water heater

- thermal energy network

- variable refrigerant flow heat pump system

The Colorado Energy Office has established guidelines for customers to obtain these tax credits. Among these guidelines,

- Heat pumps for space heating/cooling must be designed to meet at least 80% of annual heating needs.

- A registered contractor must install the eligible heat pump technology.

- Registered contractors are required to provide the tax credit to customers as a discount off the installation cost.

- Registered contractors complete and submit the necessary paperwork to the Department of Revenue for the installed equipment.

- The state will be reimbursing registered contractors through a tax credit when the contractor files taxes.

- Customers do not need to file any paperwork to receive the discount as the tax credit is retained by the installing contractor.

- HVAC contractors installing heat pumps and heat pump water heaters are encouraged to apply to become a registered contractor.

- Additional questions are answered in this FAQ document provided by the Colorado Energy Office.

Those seeking a tax credit of equipment placed into service in 2023 should continue to use form 1322 with the Department of Revenue.

Do I Qualify?

Use this calculator (thanks Rewiring America) to input your zip code, gross income and household size to determine federal, state, and utility tax credits, rebates and incentives that your household could qualify for.

Please note, Energy Smart Colorado does not provide tax advice. Tax advisors are best to rely on for guidance on tax credits specific to your household. The following resources were referenced to provide the aforementioned guidance:

- Energy.Gov: Making our Homes more Efficient: Clean Energy Tax Credits for Consumers

- Electrek: Here’s how the new US tax credits and rebates will work for clean energy home upgrades

- Building Performance Association: This guidance document from BPA provides more information about the Inflation Reduction Act and what it may mean to you.

- Rewiring America’s Guide to the Inflation Reduction Act

- FAQs on Home Energy Rebate Programs: This Department of Energy (DOE) page is updated monthly and provides answers to the commonly asked questions related to the programs funded by the Inflation Reduction Act.

- DOE Fact Sheet on incentives.

It will be 2025 before the rebate programs launch in Colorado. Canary Media offers some advice on steps households can take today to prepare homes for the electrification opportunities:

- Rebates for home energy upgrades are coming soon. Here’s how to plan.

- And the Department of Energy provides additional resources on making clean energy choices today.

- Additionally, this database of Colorado energy efficiency and renewable energy tax credits and rebates may provide current incentives.